An SDIRA custodian differs since they have the right employees, knowledge, and potential to take care of custody of your alternative investments. The first step in opening a self-directed IRA is to locate a service provider that's specialized in administering accounts for alternative investments.

Criminals often prey on SDIRA holders; encouraging them to open up accounts for the purpose of generating fraudulent investments. They often fool traders by telling them that In case the investment is accepted by a self-directed IRA custodian, it needs to be genuine, which isn’t accurate. Once more, Ensure that you do comprehensive research on all investments you end up picking.

Believe your Mate may very well be setting up another Facebook or Uber? Having an SDIRA, you could spend money on brings about that you think in; and probably love bigger returns.

Customer Aid: Seek out a service provider which offers focused support, together with usage of knowledgeable specialists who will reply questions on compliance and IRS policies.

At times, the charges connected to SDIRAs may be larger and much more complicated than with a regular IRA. It is because of the elevated complexity affiliated with administering the account.

This includes being familiar with IRS regulations, running investments, and staying away from prohibited transactions that may disqualify your IRA. A lack of information could lead to pricey errors.

Real-estate is among the most well-liked options amongst SDIRA holders. That’s because you can put money into any type of real estate having a self-directed IRA.

Building essentially the most of tax-advantaged accounts allows you to keep a lot more of The cash that you just invest and make. Dependant upon no matter whether you end up picking a traditional self-directed IRA or simply a self-directed Roth IRA, you have the probable for tax-totally free or tax-deferred advancement, furnished particular disorders are met.

Complexity and Duty: With the SDIRA, you've got far more Regulate more than your investments, but You furthermore may bear more responsibility.

Be accountable for how you mature your retirement portfolio by utilizing your specialized expertise and pursuits to invest in assets that match together with your values. Acquired experience in real-estate or personal equity? Use it to aid your retirement planning.

Place just, for those who’re searching for a tax efficient way to create a portfolio that’s additional tailor-made on your interests and expertise, an SDIRA might be The solution.

Opening an SDIRA can give you entry to investments Commonly unavailable by way of a lender or explanation brokerage business. Below’s how to start:

Being an Trader, nonetheless, your choices will not be restricted to shares and bonds if you end up picking to self-immediate your retirement accounts. That’s why an SDIRA can change your portfolio.

Number of Investment Possibilities: Ensure the supplier permits the kinds of alternative investments you’re interested in, such as property, precious metals, or private fairness.

No, You can't spend money on your own personal company with a self-directed IRA. The IRS prohibits any transactions concerning your IRA and your personal organization as you, since the owner, are thought of a disqualified individual.

Ahead of opening an SDIRA, it’s important to weigh the prospective advantages and drawbacks determined by your distinct monetary goals and possibility tolerance.

As opposed to shares and bonds, alternative assets are sometimes more challenging to promote or can feature stringent contracts and schedules.

The tax strengths are what make SDIRAs desirable For lots of. An SDIRA Get the facts may be each common or Roth - the account sort you choose will count mainly on your investment and tax strategy. Check out along with your fiscal advisor or tax advisor should you’re Uncertain and that is finest in your case.

Going resources from just one sort of account to a different variety of account, such as going cash from a 401(k) to a standard IRA.

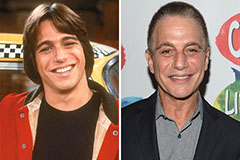

Tony Danza Then & Now!

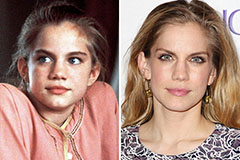

Tony Danza Then & Now! Anna Chlumsky Then & Now!

Anna Chlumsky Then & Now! Heath Ledger Then & Now!

Heath Ledger Then & Now! Heather Locklear Then & Now!

Heather Locklear Then & Now! Robin McGraw Then & Now!

Robin McGraw Then & Now!